How to Use Full Stochastics in Your Trading

Fear can destroy a stock in seconds.

But it can also lead to quite a bit of opportunity.

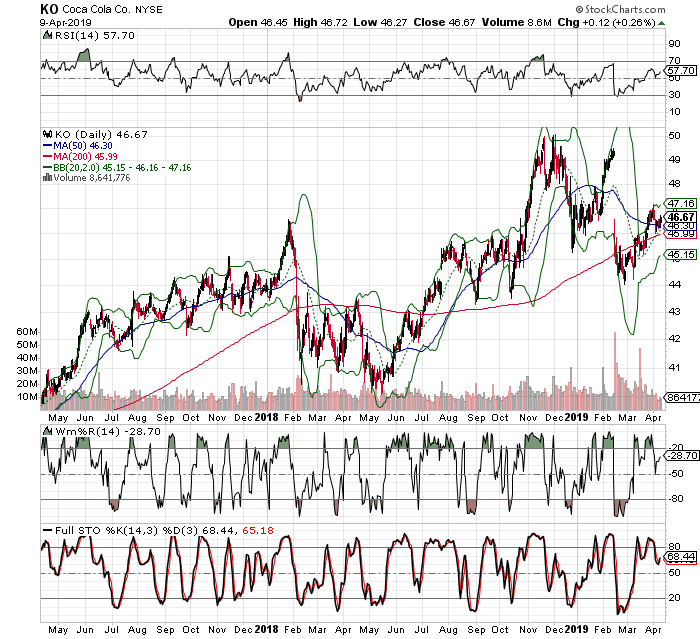

Look at Coca-Cola (KO), for example in late February 2019.

Not long ago, the stock plunged out of the sky after CEO James Quincey said the company tempered expectations after noting a slowdown late 2018.

“We think we have a great plan, we’ve got good momentum, but we’re being realistic and cautious on the global outlook,” as noted by The Wall Street Journal.

The uncertainty and fear sent the stock screaming lower.

However, several indicators told us the stock had become far too oversold, far too fast.

As we pointed out in late February 2019, notice what happens about 80% of the time when the stock touches or penetrates its lower Bollinger Band (2,20). Not long after, the stock bounces.

Then, notice what has historically happened when the lower Band is hit, and RSI hits or penetrates its lower 30-line. The stock bounces. We can confirm again with MACD. We can also confirm with Williams’ %R (W%R). Each time this indicator dips to or below its 80-line, and confirms the other oversold indicators, the stock bounces.

There’s another indicator many technicians rely on.

Full STO: Full Stochastics

Full Stochastics uses the features of Slow and Fast Stochastics.

It combines %K, or the slow stochastic that looks at current value. It also combines, %D, which is equal to a three-period moving average of %K. We use them to compare a closing price of a stock to a range of prices over a set period of time.

While it sounds difficult to use, all we’re looking for is what is shows us as far as overbought and oversold conditions. For example, you’ll notice that when Full STO drops to or below its 20-line, that typically marks the bottom. When Full STO pushes to or above its 80-line, we have an overbought condition.

Notice what happens when Full STO agrees with the other technical indicators on this chart of KO. About 80% of the time, we’ll see a reversal in the opposite direction.

Use Full STO the next time you’re trying to spot opportunity. It may just lead to you next successful trade.