Three of the Best Ways to Hedge for Market Downside

Markets are a fickle beast.

Even when the U.S. and China neared a trade deal, markets began to pull back in March 2019.

While many shifted blame to the President for the move lower, we had to consider that markets were technically stretched. We were overdue for a pullback.

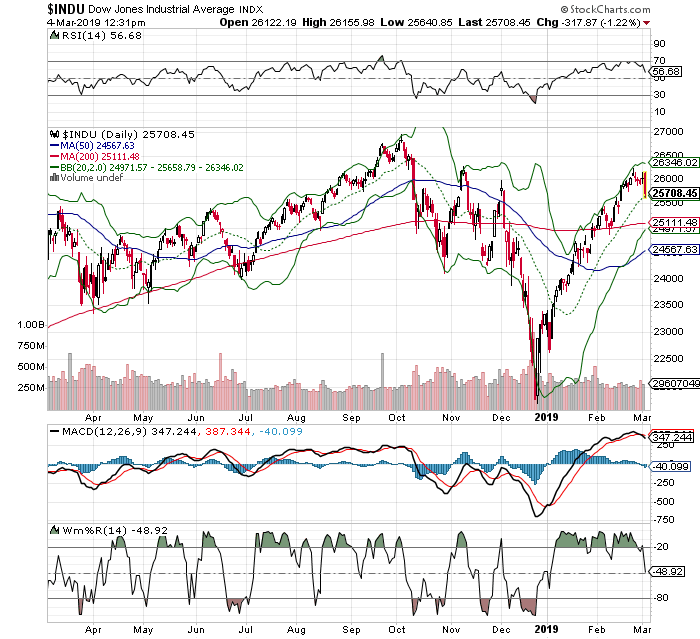

In fact, since the start of 2019, the Dow Jones exploded from 23,058 to a high of 26,241.

Unfortunately, the Dow Jones got caught at triple-top resistance. If we looked back over the last few months, we could see that whenever the Dow challenged this level, a pullback followed.

By failing to break above that resistance, panic is returning.

We also had to consider that relative strength (RSI) was stretched to its 70-line, overbought and confirmed with an over-extension on MACD. We could also look at Williams’ %R, which marks market tops when it moves above its 20-line.

We could also clearly see the index was challenging its upper Bollinger Band (2,20).

Up to 80% of the time when these indicators align in overbought or oversold territory, we typically see a pivot in the other direction. So, this move came as no surprise.

Unless the markets could higher and break above triple top resistance, the Dow Jones could break lower to support just below 25,000.

At the same time, the fear gauge, or the Volatility Index (VIX) was just beginning to break higher from oversold conditions as well. In fact, it was also pivoting after RSI, MACD and Williams’ %R became stretched in oversold territory, too.

When this happens, you must prepare your portfolio for potential volatility.

We can do that with three different volatility-based trades:

- iPath S&P 500 VIX Short-Term Futures (VXX)

- ProShares Ultra VIX Short-Term Futures (UVXY)

- VelocityShares Daily 2x VIX Short-Term ETN (TVIX)

In fact, each time markets become as stretched as they were in March 2019, these are some of the best “go-to” trades to consider. The last thing you want to do is be 100% long in a market that’s as volatile as the one we have today.