Trading Buy-Write or Covered Call Options

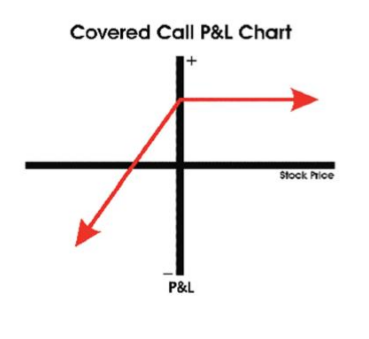

If you are buying and holding a stock, and you are neutral to slightly bullish about the stock's upside potential, then a Covered Call Options Strategy (also known as a Buy-Write) can be a way to receive enhanced premiums, and can also offset some losses if the stock declines in value.

For every 100 shares of a stock that you are buying and holding, you would short one call option, which controls 100 shares of stock.

Anatomy of a Covered Call

Construction – Long stock, short one call for every 100 shares of stock owned.

Function – To enhance profitability of stock ownership and to provide limited downside protection against adverse stock movement.

Bias – Neutral to slightly bullish.

When to Use – When you feel the stock will trade up slightly or in a tight range for a period of time and you plan on holding the stock for longer term.

Profit Scenario – If stock rises, profit will be enhanced by premium received. If stock stagnates, you will profit from premium received from call sale.

Loss Scenario – If stock trades lower than the point defined by your purchase price minus the premium received from call sale you will lose dollar for dollar. Call premium received will act as an offset to the loss in the stock.

Key Concepts – If stock trades up aggressively, you will only profit up to a stock price defined by the strike price plus option price. If the stock continues higher above that point (breakeven), you will incur lost opportunity. Further, if stock closes above strike price, stock will be called away unless necessary adjustment is made. Philosophically identical to the Sell-Write position except in opposite direction. Time decay helps the position.

Covered Call Example (Source: Investopedia)

For example, let's say that you own shares of the hypothetical TSJ Sports Conglomerate and like its long-term prospects as well as its share price but feel in the shorter term the stock will likely trade relatively flat, perhaps within a few dollars of its current price of, say, $25. If you sell a call option on TSJ with a strike price of $26, you earn the premium from the option sale but cap your upside. One of three scenarios is going to play out:

a) TSJ shares trade flat (below the $26 strike price) - the option will expire worthless and you keep the premium from the option. In this case, by using the buy-write strategy you have successfully outperformed the stock.

b) TSJ shares fall - the option expires worthless, you keep the premium, and again you outperform the stock.

c) TSJ shares rise above $26 - the option is exercised, and your upside is capped at $26, plus the option premium. In this case, if the stock price goes higher than $26, plus the premium, your buy-write strategy has underperformed the TSJ shares.