The Most Lucrative Options Trading Tool the Pros Use

For an individual trader, options can be a little intimidating.

However, if you know the pitfalls and how to increase your odds of success, the better you stand to do overall.

All too often many investors trade options by buying out-of-the-money, short-term options, since they cost less than long-term options.

For example, out-of-the-money calls (those are options where strike price is above the stock price) are especially popular because they’re cheap, and seem to follow the old Warren Buffett paradigm we all love- buy low, sell high.

But is this always the best option strategy?

Let’s say you’re bullish on Facebook (FB), which is trading at $100. As a beginning options trader, you might be tempted to buy calls 30 days from expiration with a strike price of $120, at a cost of $0.15 or $15 per option contract. The reason most traders do this is because they can buy a lot of them for a very low cost.

Now, let’s do the math.

Purchasing 100 shares of FB at $100 would cost $10,000, but for the same $10,000 you can buy 666 contracts of $120 calls and control 66,600 shares. Now, if FB hits $121 within the next 30 days and the $120 calls are now trading at $1.5 or $105 per option contract, just prior to expiration. You would make $59,940 in a month on a $10,000 capital.

At first glance this kind of leverage is incredible, but don't get carried away with it.

One problem with short-term, out-of-the-money options is that you not only have to be right about the direction of the stock move, but you also have to be right about the timing. That alone can increase the difficulty of the trade. Not only does the stock have to get past the strike price, but it also has to do so in a set period of time.

In the case of the $120 calls on FB, you will need the stock to reach $120 within 30 days to make a profit. This dual objective of having to be right on the direction plus the timing really lessens the probability of an option trade being a winning trade when buying those.

Based on probabilities, there is only about 5% chance for the stock to reach $120 to $121 by expiration. So in order to make money on an out-of-the-money option, you either need to outwit the market or just be really lucky.

Imagine that FB only moved to $110 during the 30 days of your option’s lifetime.

You may have been correct that the stock would move higher, but it missed the mark within your set time frame. As a result, you lost your money on the trade.

Based on this trade example, a better goal for every trade can be to select trades based on what provides the most consistent positive returns, not a one-time, big winner.

Consistency is derived from making high probability trades based on reliable data and facts. Where there is a big disadvantage, such as the one you saw in the FB option scenario, you could usually just look at the flip side of the coin and see an equal and opposite advantage.

In this case being a seller of options gives you a huge advantage over being a buyer of options. All the pros know this and take advantage of it, and so can you. As a seller all of the details in the FB example stay the same, but in your favor, instead of against you.

This is why professional trades look first to take advantage of selling options for profit generation and hedging.

By selling options, we are in essence selling time:

- This strategy creates a powerful dynamic

- It is yours for the taking

- An options is like a coupon that has to be redeemed by an expiration date or else it is no longer valid.

HOW TO DO IT AND WHAT IS INVOLVED

The most important option factor for income generation is the understanding the concept of time.

Time value is used for trading strategies that take advantage of the accelerated time decay on an option into its expiration. Options income strategies are very tied to time value and the impact it had on the price of an option. It is that simple and you can use this information to make money.

WHAT IS TIME VALUE?

Time value (TV), the (extrinsic) value of an option is the premium a rational investor will pay over its current exercise value (intrinsic value), based on its potential to increase in value before expiring. This probability is always greater than zero, thus an options is always worth more than its current exercise value.

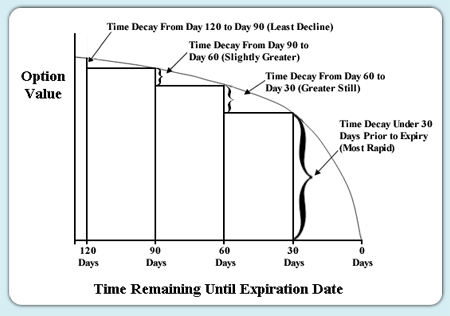

Take a look at the following chart to see just how predictable and powerful this option-time paradigm is and answer one simple question.

This chart represents the time decay concept in options trading.

In the 90-120 day period the time decay is very small. Then, as you get closer to expiration, you can see that the time decay really accelerates. Now, if the underlying security price was to go sideways, having no directional trend, would you have wanted to be long an option 120-90 days out, or would you have rather sold an option?

While there is some slight variation, this is the common natural time value progression for all options. And it is seriously like falling off of a cliff, blindfolded.

The free tool for determining the actual time decay of an option sis called Theta, which is provided on your brokerage platform.

Theta helps you know how much an option’s premium is decaying each day. For example, a Theta of -.01, indicates that the option’s premium is decaying by $1 a day. Of course, Theta changes over time and increases the closer the options gets to its expiration date. So you can see how important this date can be for options traders. And that is it, simple but very powerful when used correctly. Use the information provided by a Theta to check how much your options are decaying each day, if you own any at this time.

The following is an image of the Theta display from the Think or Swim trading platform. Getting Theta usually involves just a simple click on your brokerage platform.

So this example is Apple (AAPL) and you can see the days to expiration are 10. If you look at the Strike Price column and go down to the 114 mark (see green arrow) and then across under the Calls section, you can see that the Theta value is -.06 (also marked with a green arrow). This practically indicates that the value of the option in question is going down by $6 a day per option contract.

You can increase your skills using Theta as a seller of options to stack the probabilities way in your favor when generating income by selling options instead of paying for them.

The most common strategy is selling options, naked calls or puts, but this is not a hedged approach. You can easily reduce this risk, or hedge it, by purchasing long options to offset the un-hedged risk from selling options naked. While hedging reduces the overall returns, it is much like having insurance and it is worth that cost for risk management.

Selling options takes advantage of time decay.

And there are a number of great options trading strategies that can generate consistent income with limited risk. Return can still be significant, even with hedging protection, since many options strategies (such as a properly structured credit spread) can have probabilities of over 70% of success, even without the aid of technical analysis, which can then increase your winning probabilities even more.

The most popular hedged options income strategy that can be used regardless of the market direction is the credit spread. This strategy takes advantage of the time decay to make money while also reducing risk.

You may be wondering how to select the right income option strategy. The goal of every trader should be to select trades based on what provides the most consistent positive returns and not always the greatest. And one of the best ways to achieve this is by knowing the income option strategies that are available and then selecting the one that is the best for your trading style, trading plan and lifestyle.

Here are some of the types of income strategies you can choose from:

- Covered calls

- Calendar spreads

- Diagonal spreads

- Long iron condors

- Credit spreads

My favorite income option strategy is the credit spread for 4 main reasons and those are:

- It can work regardless of market direction

- It almost always works even if you are wrong

- The probability is over 68% even without adding technical analysis, which increases the probability even further

- It is perfect for hedging

There are 3 types of credit spreads:

- Bear call credit spread

- Bull put credit spread

- Long iron condor

Bear call credit spread is best of you think the market is probably going to go down. The strategy involves selling one call with a lower strike price, while simultaneously buying one call with a higher strike in the same month.

The bull put credit spread is best when you think that the market will probably go up. The strategy requires that you sell one put while simultaneously buying one put with a lower strike price in the same month.

The long iron condor is known for being a non-directional, low-risk trading strategy. To execute it you can combine a bull put credit spread and a bear call credit spread together.

Let’s review.

- You can sell options whit a much higher probability of success than you can buying options

- Theta is a free tool on your brokerage platform that you can use to check time decay

- Selling options strategies can be hedged or not hedged, but hedging lowers risk while slightly lowering your returns

- Credit spreads are popular income generating strategy that capitalizes on option time decay with controlled and limited risk