A Sure Way to Know When to Sell High

Buy low, sell high -- it’s an easy rule to follow.

Unfortunately, selling is often the hardest part.

“Jeez, if only I held that stock for one more day. I could have been up another $2,500” is often the thought process. What we fail to consider is that we made money. We accomplished the initial goal. Better yet, we didn’t lose anything.

That’s partly because human psychology leads us to assume that a really means that conditions are improving. We think we can make another $5,000 on a trade if we let it continue to run. Then one morning we wake up to see the stock crashed and burned, wishing we had sold. We let greed get in the way.

We ignore one of Warren Buffett’s most popular maxims – be greedy when others are fearful, and fearful when others are greedy. But as many of us can attest to, we get even greedier as others get greedy.

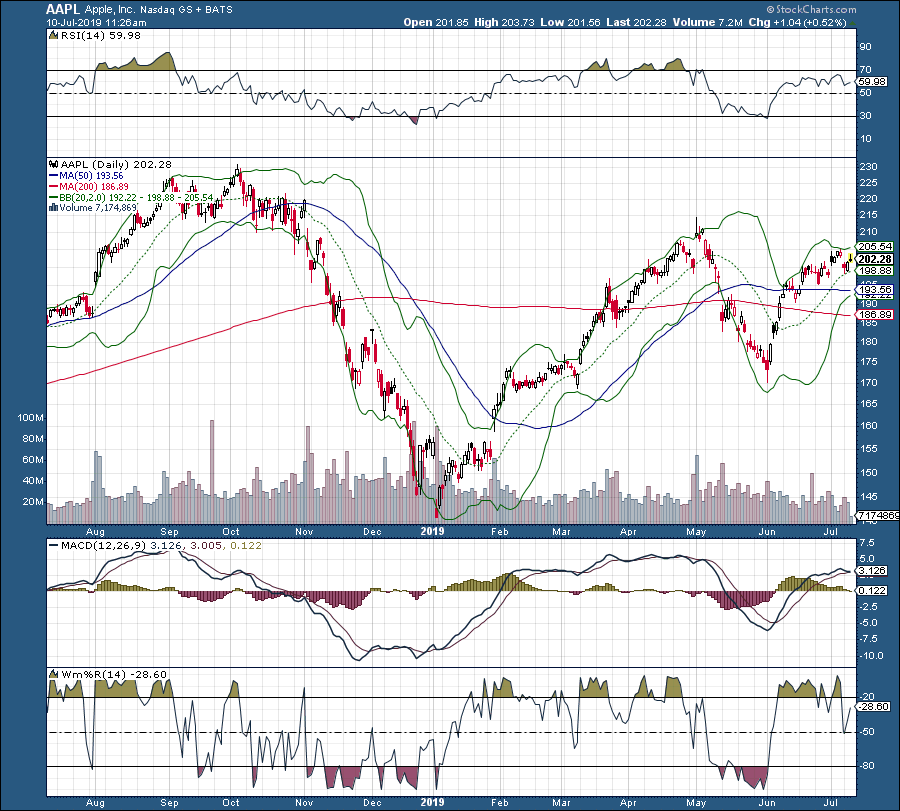

Look at Apple (AAPL) in May 2019. The stock ran up from $140 to $210 over 5 months. Most of us would take that gain and move on. Many others, though, still thought the stock could rocket even higher. Greed dictated their trade.

That’s the best way to lose money, though.

At the time, we had to consider two key elements of the trade. For one, the news of the earnings and computer viruses were apparently priced into the trade at the time. Two, the technical picture became aggressively bearish.

Look at what historically happened to AAPL every time it hit that upper Bollinger Band. It pivoted and turned lower. We can confirm that bearishness with elevated RSI, MACD and Williams % R, as well. In fact, look at what happens when the four indicators align and agree in bearish territory.

The stock pivots and pulls back. That happens up to 80% of the time.

Yet many traders ignore it. Instead, as was the case of AAPL, traders decided to keep buying even at $210 a share. Again, greed dictated the trade.