How to Spot Market Reversals with Bollinger Bands

If you pull a rubber band too far, too fast, what happens?

It snaps back, right? The same thing happens with stocks, indexes, and currencies. If they’re pulled too far in one direction, eventually they’ll snap back and revert to back to the mean. In fact, we see it happen all the time.

To spot that, we begin to look at Bollinger Bands.

In technical terms, the bands are plotted at standard deviation levels above and below moving averages. So if you see “2,20” that simple means the bands are plotted two standard deviations above and below the 20-day moving average.

They consist of three bands:

- A simple moving average (SMA) in the middle

- An upper band (SMA plus 2 standard deviations)

- A lower band (SMA minus 2 standard deviations)

Typically, when the upper band is challenged, confirmed with other indicators, we can begin to make an argument for a potential pivot lower from the upper band. Or, if the lower band is challenged, confirmed with other indicators, we can make an argument for a potential pivot higher from an oversold point.

For example, look at what has typically happened with the EUR/USD.

Each time the upper Bollinger Band (2,20) was touched or penetrated, confirmed with an overbought read on RSI, MACD, and Williams’ %R, the currency pivoted and moved lower. Each time the lower Band (2,20) was touched or penetrated, confirmed with the same indicators, the currency pivoted and moved higher.

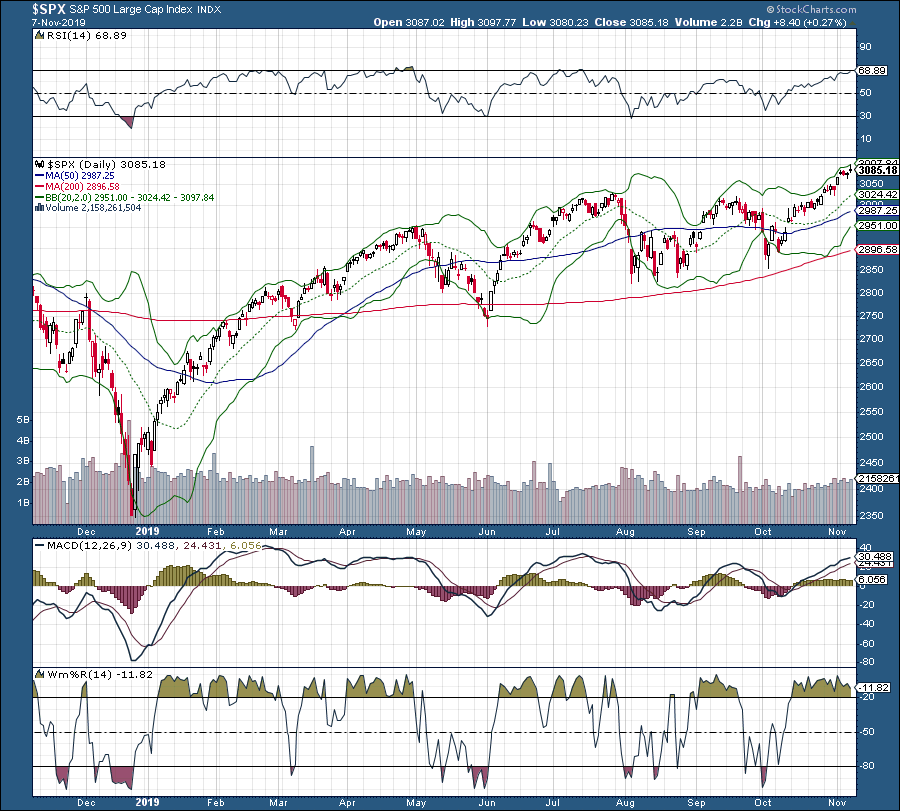

We can clearly see the same thing happens with even the S&P 500.

Up to 80% of the time, when that upper or lower band is even challenged, coupled with confirming indicators, we have seen a pivot.

It’s just another tool to be well aware of as you trade.