How Options Can Help Minimize Risk

Options are still one of the most misunderstood opportunities.

They’re too hard. They’re far too expensive. You have to be rich to trade them. Those are just some of the excuses I’ve heard over the last 20 years. But to be very honest with you those excuses are laughable.

Fact is traders can actually reduce risk with options far more often than with stocks with far bigger returns at less cost with much more flexibility.

You can use options to profit in any market, unlike a stock.

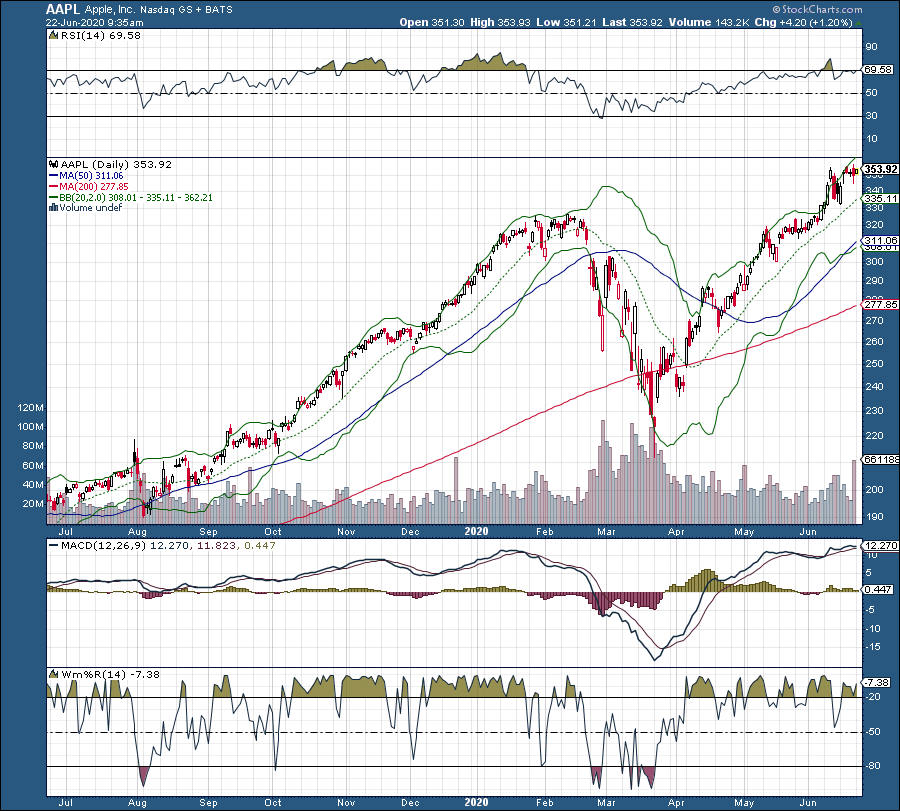

For one, we can use options as a stock-replacement strategy. As of June 2020, shares of Apple (AAPL) were up to $352. If I wanted to own 100 shares of Apple, it’d cost me $35,200. Not many of us have that laying around.

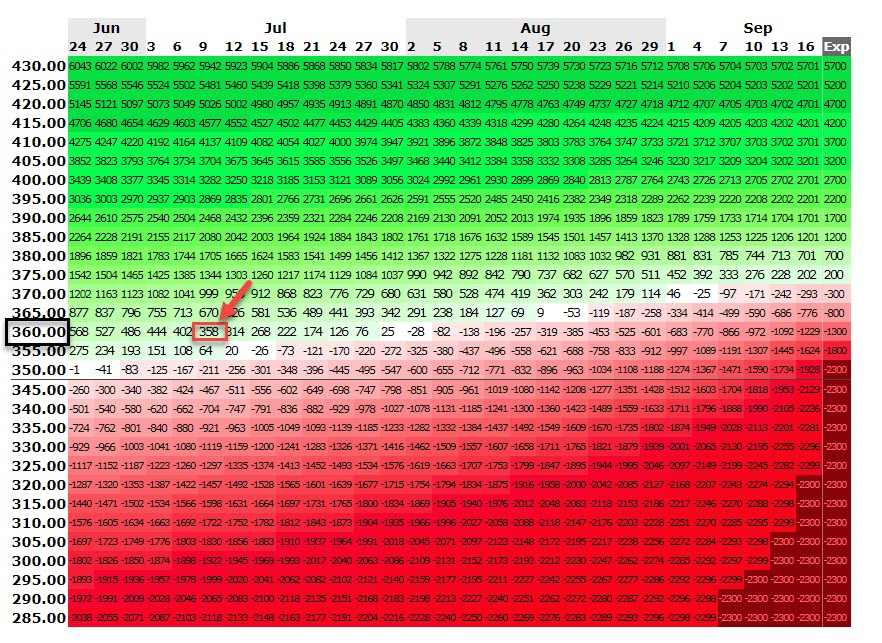

However, I can take control of those same 100 shares of Apple with Options – without ever having to own shares of Apple – by buying the AAPL September 2020 $350 calls at $23.00 for just $2,300.

That’s a savings of $32,900.

If shares of Apple move from $352 to $360 within the next 2 weeks, I can make greater than a 15% return on my investment ($360). Over the same period of time, your purchase of Apple stock at $35,200 would have appreciated by only $80 dollars.

Chart courtesy of OptionsProfitCalculator.com

Or, let’s say we believe the markets are insanely overvalued and ready to come down in a hurry. Instead of shorting the index or buying bearish ETFs, we can buy a put option, which rises as the underlying asset loses value.

Or, let’s say you’ve been watching Microsoft (MSFT) and it’s been going nowhere. Instead, it’s stuck in a range. You can turn a profit from that situation, too. In fact, you can sell a put or call option, or even use a bearish or bullish spread, which can help you generate consistent income.

That’s the beauty of options. You can’t do any of that with just a stock.

Look, options don’t have to be complex and as grossly misunderstood as they are. With a bit or knowledge, you can do wonders for your portfolio. Think of options as insurance. You’d own it on your car and your house, so why not your investments?

Better yet, they allow you to profit in bull, bear and flat markets.

They allow you to protect gains in a shaky asset. They can help you produce consistent income. And you can do it all for a fraction of the cost of a stock. In short, learn options. Know options. And stop with the excuses.

You either want to make real money, or you don't.