Long and Short Butterfies

The Option Butterfly Strategy is a limited risk and limited profit trade, but on a typical butterfly trade, the profit potential is much higher than the potential loss and can offer a large positive Reward-to-Risk return on capital. The Butterfly Spreads involve 3 different option strike prices, all within the same expiration date, and can be created using either calls or puts.

Butterflies are very dynamic and can be traded for a variety of different reasons with different goals in mind such as Income, Directional, Non-Directional and Hedging.

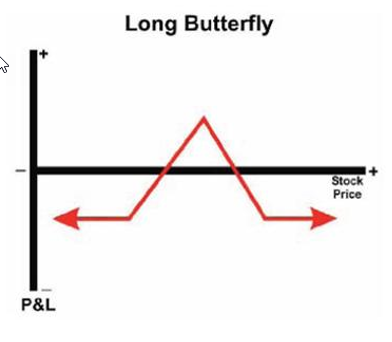

Long Option Butterfly Spread

The Long Option Butterfly Spread can use either puts or calls and is designed to achieve maximum profit at a specific price target at the expiration of the option.

This strategy benefits from time decay, and offers a great Reward-to-Risk return. Done for a debit.

Construction – Short two calls (puts) of same month and strike while long a call (put) above and long a call below both equidistant from the strike of the two short calls (puts). In the case of an “Iron Butterfly,” short a straddle while long a strangle around it.

Function – Premium collection strategy with upside and downside protection. Also short volatility play.

Bias – Stagnant. When to Use – When you feel the stock will trade in a very tight range near a strike price and stagnate there. Also if you feel the stock has a likely hood of a decrease in implied volatility. The butterfly allows you to take advantage of these potential situations while offering the investor a hedged position.

Profit Scenario – Maximum profit occurs when stock closes directly at the strike of the two short options and decreases as stock moves in either direction away from the strike.

Loss Scenario – Maximum loss occurs when stock closes at either strike of the long options. Maximum loss is limited.

Key Concepts – The long butterfly is an ideal strategy for premium collectors who seek to minimize potential losses in the event the stock moves adversely. This strategy can also take advantage of expected decreases in implied volatility. The strategy can be viewed as two separate trades.

In the case of a traditional butterfly, the position can be broken down into two vertical spreads, one long and one short with each sharing the same short strike, and having different but equidistant long strikes.

In the case of the Iron Butterfly, the position can be broken down to a short straddle surrounded by a long strangle. Butterflies are best entered into in further out months.

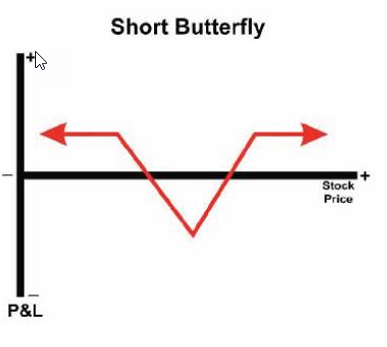

Short Option Butterfly Spread

This strategy can use either puts or calls and is designed to profit from a price move outside the short wings at the expiration of the option. Done for a credit.

Construction – Long two calls (puts) of same month and strike while short a call (put) above and short a call below both equidistant from the strike of the two long calls (puts). In the case of an “Iron Butterfly,” long a straddle while short a strangle around it.

Function – Limited directional stock movement play. Also long volatility play.

Bias – Limited directional but in either direction.

When to Use – When you feel the stock will trade away from a strike but not aggressively. Also if you feel the stock has a likely hood of an increase in implied volatility. The short butterfly allows you to take advantage of these potential situations while offering the investor a hedged position.

Profit Scenario – Maximum profit occurs when stock closes at or above the highest of the short strikes or at or below the lowest of the short strikes. The trade will also be profitable in event of increasing implied volatility.

Loss Scenario – Maximum loss occurs when stock closes at either strike of the long options. Maximum loss is limited.

Key Concepts – Short butterflies are an ideal strategy for long volatility players who seek minimizing potential loss in the event the stock moves adversely. The strategy can be broken down viewed as two trades.

In the case of a traditional butterfly, the position can be broken down into two conflicting vertical spreads, one long, and one short with each sharing the same short strike and different but equidistant long strikes.

The Iron Butterfly can be broken down to a long straddle surrounded by a short strangle. Butterflies are best entered into in further out months.