Long and Short Strangles

The option strangle is a volatility strategy, like the straddle, that can make a profit based on an increase or decrease in the implied volatility of a stock's option.

The difference is that the strikes are not set ATM but are set OTM.

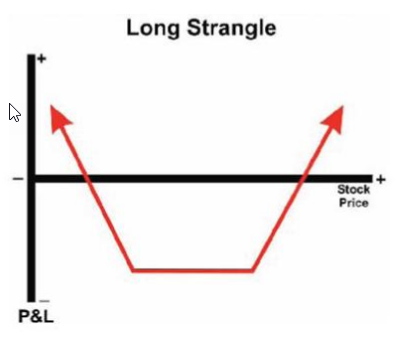

Long Strangle

The Long Strangle is a simple adjustment to the Long Straddle to make it slightly cheaper which creates a lower cost basis and therefore potentially higher returns on capital at risk.

Construction – Long one call and one put with different strike prices but in the same expiration month in a one to one ratio. Both options are usually out-of-the-money.

Function – To take advantage of large potential stock movements in either direction or if you anticipate an upward movement in implied volatility.

Bias – Volatile in either direction

When to Use – Normally around news release time (i.e. earnings) when you feel that the news can affect the stock aggressively but aren’t sure in which direction. Also, good to use when you feel implied volatility is likely to increase sharply.

Profit Scenario – Profit will be obtained in a dollar for dollar fashion if the stock closes outside of the parameters of the breakevens set forth by first adding the strike price of the call to the amount paid for the strangle then subtracting the amount paid for the strangle from the strike price of the put. Theoretically, unlimited potential reward.

Loss Scenario – Maximum loss occurs if stock closes between the break-even points as defined above. Maximum loss is limited to price paid for strangle.

Key Concept – Because of large decay associated with this position, time sensitivity is critical. Once anticipated stock or volatility movement occurs, it is critical to close down position in order to secure profits and eliminate further risk of substantial decay.

Philosophically identical to the straddle except the strangle’s wider breakevens require a larger stock movement. The trade off for this is the lower cost of the strangle.

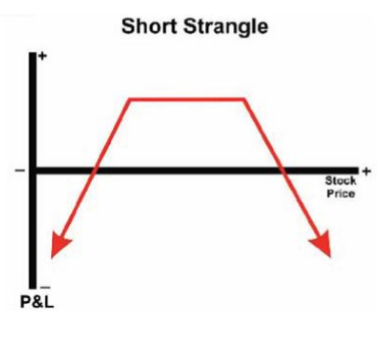

Short Strangle

The Short Strangle is a simple adjustment to the Short Straddle to improve the probability of a profitable trade by widening the strikes and therefore the breakeven points. Instead of selling ATM options, sells OTM calls and puts which lowers the net credit but widens the breakeven points.

Construction – Short one call and short one put with different strike prices, in the same expiration month and in a one to one ratio. Both options are usually out-of-themoney

Function – To take advantage of a stock entering a stagnant or low volatility trading range.

Bias – Stagnant

When to Use – Normally around a time away from expected news releases (i.e. earnings) when you feel that the lack news can lead to a period of stagnation or lack of movement of the stock without directional bias. Also, good to use when you feel implied volatility is likely to decrease sharply.

Profit Scenario – Profit will be obtained if the stock closes inside of the parameters of the breakevens set forth by first adding the strike price of the call to the amount paid for the strangle then subtracting the amount paid for the strangle from the strike price of the put. This strategy has a potential reward limited to the amount received from the sale.

Loss Scenario – Loss occurs if stock closes outside break-even points as defined above. Maximum loss occurs as stock continues to trade further outside and away from either breakeven point. Potential loss is theoretically unlimited.

Key Concept – Because of large decay associated with this position, time sensitivity is critical. The longer the stock remains stagnant or between the two break-even points, the better for the seller.

The passage of time aids this strategy as well as decreases in implied volatility. Due to the nature of the position, maximum loss is theoretically unlimited.