Options Strategy: The Collar

An investor writes a call option and buys a put option with the same expiration as a means to hedge a long position in the underlying stock. This strategy combines two other hedging strategies: protective puts and covered call writing.

Usually, the investor will select a call strike above and a long put strike below the starting stock price. There is latitude, but the strike choices will affect the cost of the hedge as well as the protection it provides. These strikes are referred to as the 'floor' and the 'ceiling' of the position, and the stock is 'collared' between the two strikes.

Description (Source: The Options Industry Council)

An investor writes a call option and buys a put option with the same expiration as a means to hedge a long position in the underlying stock. This strategy combines two other hedging strategies: protective puts and covered call writing.

Usually, the investor will select a call strike above and a long put strike below the starting stock price. There is latitude, but the strike choices will affect the cost of the hedge as well as the protection it provides. These strikes are referred to as the 'floor' and the 'ceiling' of the position, and the stock is 'collared' between the two strikes.

The put strike establishes a minimum exit price, should the investor need to liquidate in a downturn.

The call strike sets an upper limit on stock gains. The investor should be prepared to relinquish the shares if the stock rallies above the call strike.

Construction – Long stock, simultaneously long one out-of-the-money put and short one out-of-the-money call per every 100 shares of stock owned.

Function – Provide no-to-low cost maximum profit protection for a long stock position.

Bias - cautious or even short term bearish.

When to Use – When you feel that your long stock position may run into a tough period of time but you want to keep the position.

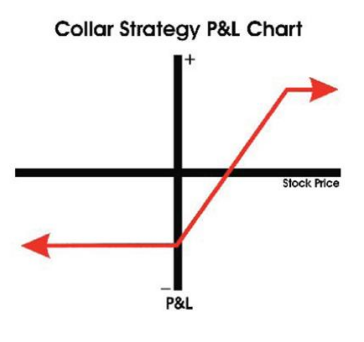

Profit Scenario – Depending on how you set up the collar and the prices of the put and call, you may make a very negligible amount. If the stock trades up, you may make a little.

Loss Scenario – Depending on how you set up the collar and prices of the put and call, you may lose a little money. If the stock trades down, you may also lose a little but the collar will limit it to a set amount regardless of how low the stock goes.

Key Concepts – Collars are not designed to make money. They are designed to provide maximum downside protection, similar to the protective put, but at a much better price. The premium received from the sale of the call will offset the amount paid for the put.

Collar Example (Source: Investopedia)

Assume an investor is long 1,000 shares of stock ABC at a price of $50 per share, and the stock is currently trading at $47 per share. The investor wants to temporarily hedge the position due to the increase in the overall market's volatility. Therefore, the investor purchases 10 put options with a strike price of $45 and writes 10 call options with a strike price of $60. Assume he options positions are implemented for a debit of $1.50. The maximum profit is $11,500, or 10 * 100 * ($60 - $50 + $1.50). Conversely, the maximum loss is $6,500, or 10 * 100 * ($50 - $45 + $1.50).