Get "Insurance" on Your Profits with Protective Puts

If you own a stock and want to protect that stock's value, then Protective Puts act like an insurance policy on your investment.

Since it will cost you some money to put on this trade, it can put limits on your profits on the stock that you own, but it also protects you if your stock loses value.

Construction – Long stock, long 1 put per every 100 shares of stock

Function – To provide maximum downside protection for long stock position. Long stock insurance policy.

Bias – Bullish but cautious When to use – When wishing to protect profits of long stock position while wishing to retain position. Also, to protect speculative stock purchases (i.e. purchasing stock on potential chart break out from present trading range according to Technical Analysis.

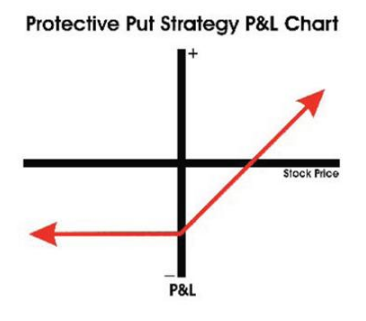

Profit Scenario – If stock continues to trade up by more than the amount paid for the puts. Once above that level, position makes dollar for dollar with stock.

Loss Scenario - If the stock trades down, loss will be felt until stock reaches point defined by puts strike price minus put price. At that level, position will cease losing. If stock stagnates, loss will equal put price due to decay.

Key Concepts – Due to the acquisition of time decay from the long put, the position is best used for protection of already existing profits, or when a potentially aggressive or explosive upside move in the near future is a good possibility. Other side of the Sell-Write position.

Philosophically identical to the Synthetic Put strategy except for anticipation of stock going up.

Protective Put Example (Source: Investopedia.com)

If an investor purchased 100 shares of stock XYZ at $10 per share, and the price increased to $20 but he has not sold it, he has unrealized gains of $10. If he doesn't want to sell the stock yet (perhaps because he thinks it will appreciate further) but he wants to make sure he doesn't lose the $10 in unrealized gains, he can purchase a put option for that same stock (called the "underlying stock") that will protect him for as long as the option contract is in force. If the stock continues to increase in price, say, going up to $30, the investor can benefit from the increase. If the stock declines from $20 to $15 or even to $1, the investor is able to limit his losses because of the protective put.

Assume the investor purchased a put option on stock XYZ with a strike price of $15 for 75 cents. Therefore, the investor's maximum loss is limited to $575, or 100 x ($10 - $15 - $0.75), rather than $1,000 if he did not purchase the put option.