Three Reasons Small Caps are Booming

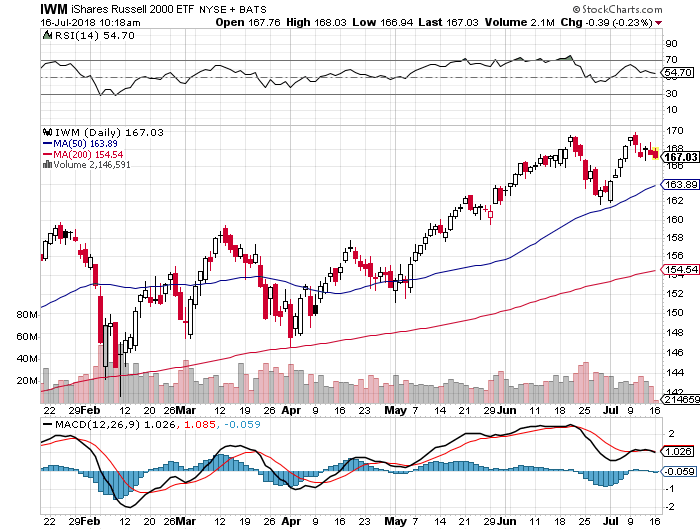

Small-cap stocks have been unbelievable this year, hitting new highs in June 2018.

In fact, the Russell 2000 is up 9% on the year through July 16, 2018.

- The S&P Small Cap 600 Index is up 11%.

- The Dow Jones Industrials is up a whopping 1%.

- The NASDAQ is up 1%

- The S&P 500 is up 4%.

.png)

And that’s not likely to change any time soon for three reasons.

Reason No. 1 – Tax Reform

We expect for small cap stocks to lead the charge well into 2019, especially if we see a second tax cut that could drop the corporate tax rate to 20%.

According to the Black Rock blog:

“Small-cap companies tend to source a larger portion of their revenue domestically compared to large caps. As such, they pay an estimated corporate tax rate of around 32% vs. 28% for larger firms. Recent tax cuts passed by Congress therefore benefit smaller companies more than larger ones–a trend that has contributed to out-performance at the sector level within small caps, especially amongst tax-heavy sectors such as financials and telecoms.”

Reason No. 2 – U.S. Economic Growth

Thankfully, most small cap stocks have limited international exposure to tension. “U.S. small caps are nearly twice as sensitive to changes in domestic economic growth as large caps, and much less sensitive to international economies. This relative domestic preference has helped U.S. small caps as economic data have remained robust while European data have weakened substantially,” notes Black Rock.

Reason No. 3 – U.S. Dollar Strength

Since April 2018, the U.S. dollar has rallied 7% against a basket of foreign currencies. This has led to foreign currency weakness that has damaged the profits of larger-cap company profits. Meanwhile, this doesn’t affect small caps much at all.

In short, if you’re looking for opportunity in this market, you really can’t go wrong betting on small cap stocks. No wonder investors have been moving into small cap ETFs along the way, including:

The IWM seeks to track the investment results on a broad range of small cap stocks. The ETF has been one of the more popular small cap ETFs, running from $154 to $132.50 to $167 between September 2017 and July 2018. Some of its top holdings include Five Below Inc., Etsy Inc., Stamps.com Inc., and Cree Inc.

.png)

The ETF provides access to the same securities as the S&P Small Cap 600 Index, weighted by top line revenue instead of market capitalization. Some of its top holdings include Super Value, JC Penney Company Inc. and Group 1 Automotive Inc.

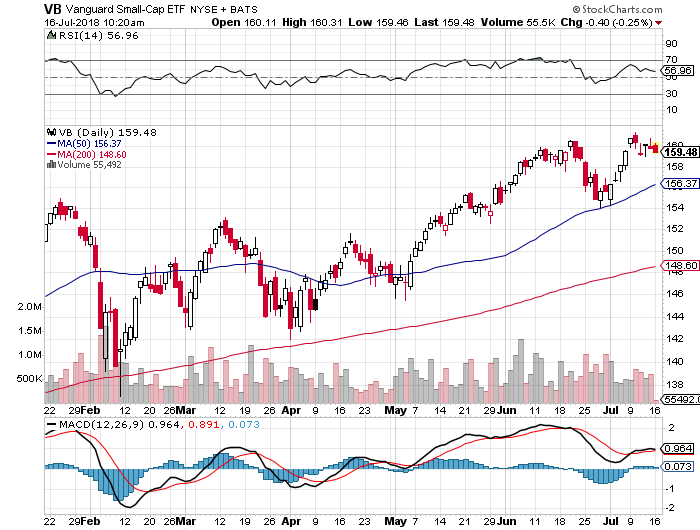

Vanguard Small Cap Index Fund (VB)

Expense Ratio: 0.5%

The VB Seeks to track the performance of the CRSP US Small Cap Index, which measures the investment return of small-capitalization stocks. Some of its top holdings include TransUnion, CDW Corporation, Copart Inc., Steel Dynamics Inc. and ON Semiconductor Corporation.