Portfolio Protection: Why It Is Important to Hedge in 2018

In early 2018, the reins of the Federal Reserve were handed to Jerome Powell.

With it, came concerns the central bank could raise interest rates.

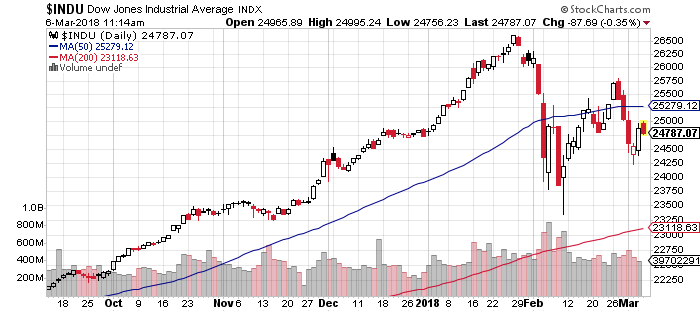

Of course, it had many on Wall Street terrified of a potential market downturn like we saw at the start of February 2018 and again in March 2018.

That’s because higher interest rates could pull cash out of the stock market, and potentially tighten credit for consumers and businesses alike.

But even that fear may not slow the future pace of hikes from Powell’s Fed, some noted.

In fact, according to testimony before Congress, Powell noted that the Fed sees steady growth continuing and no serious risks on the horizon that might make the central bank pause its planned rate hikes, as noted by The Globe and Mail.

And, in the minutes of the January 30-31 FOMC meeting, it was noted that:

"The economic expansion continues to be supported by steady job gains, rising household wealth, favorable consumer sentiment, strong economic growth abroad, and accommodative financial conditions."

Shortly after, Powell hinted at four hikes this year alone after only calling for three hikes at the December 2017 FOMC meeting.

“We’ve seen continuing strength in the labor market, we’ve seen some data that will — in my case — add some confidence to my view that inflation is moving up to target,” Powell added, as quoted by Yahoo Finance. “We’ve also seen continued [economic] strength around the globe, and we’ve seen fiscal policy become more stimulative.

What we have to consider is that the Fed is seeing imminent inflationary concerns.

For one, the CPI increase in January 2018 was greater than expected. Even if we remove food and energy from CPI, core CPI still increased at an annual rate of 3.6%, which well above the long-term Fed target of 2%.

Two, we were seeing a stronger jobs market. According to CNBC, the 2.6% jump in the Employment Cost Index in 2017 “is the highest annual increase in almost 10 years. Firms will pass these additional labor costs to consumers in the form of higher prices.”

Three, there were concerns that tax reform could inflate inflationary concerns, as well.

Of course, with the fear of higher interest rates and a potential drop in market value, questions on how to protect portfolios follow.

Tip No. 1 – Have Discipline

When markets fall apart, we tend to get a bit emotional. Logic goes right out the window. Discipline means holding on to good stocks, even if they move lower. It also means avoiding the desire to make speculative, risky bets hoping to break even.

We have to remember that markets are resilient. They don’t stay down for long.

Also, be willing to see out the “blood in the streets” trades.

When markets crash, investors are typically presented with outstanding buy opportunities in oversold stocks that no one else wants to touch.

In short, remain calm and focused. Don’t sell out of panic. Just sit tight.

If you take a look at this 48-year chart of the Dow Jones you can clearly see it pays to stay invested even in the worst of times.

Tip No. 2 – Buy Gold as a Safe Haven

When markets turn south, investors typically flock to precious metals like gold and silver. Therefore it’s always wise to keep a small percentage of your portfolio in precious metals as a hedge for a potential market meltdown. Given the fact that precious metals act as a great form of insurance against global chaos and stock market meltdowns, it’s one of the safer tools.

Tip No. 3 –Diversify with Bearish Investments

Some interesting ways to prepare for downside include buying:

- The Pro Shares Short S&P 500 ETF (SH)

- The Pro Shares Ultra Short S&P 500 (SDS)

- The Pro Shares Short Russell 2000 (RWM)

Another strategy for protecting a portfolio is to buy a put option on an exchange-traded fund like the SPDR S&P 500 ETF. Buying a put is like homeowner's insurance in that investors pay a small premium to protect a much larger and more valuable asset, he says.